All Categories

Featured

Table of Contents

- – Proven Passive Income For Accredited Investors

- – Expert Best Crowdfunding Sites For Accredited ...

- – Secure Investments For Accredited Investors N...

- – Proven Private Investments For Accredited Inv...

- – Professional Venture Capital For Accredited ...

- – Profitable Venture Capital For Accredited In...

For instance, expect there is a private whose income was $150,000 for the last three years. They reported a primary residence value of $1 million (with a home loan of $200,000), a cars and truck worth $100,000 (with an exceptional funding of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This includes an estimation of their properties (other than their key residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle financing equaling $50,000. Since they meet the web well worth requirement, they certify to be an accredited financier.

Proven Passive Income For Accredited Investors

There are a couple of less typical qualifications, such as handling a depend on with more than $5 million in assets. Under government safeties legislations, just those that are approved investors may join certain safety and securities offerings. These may consist of shares in private positionings, structured items, and personal equity or bush funds, to name a few.

The regulators want to be particular that individuals in these extremely risky and intricate investments can fend for themselves and judge the risks in the lack of government protection. passive income for accredited investors. The certified capitalist regulations are designed to safeguard prospective capitalists with minimal economic knowledge from high-risk endeavors and losses they might be ill equipped to hold up against

Please review North Resources's and its background on. Investments secretive offerings are speculative, illiquid and entail a high degree of risk and those capitalists who can not manage to lose their entire investment and that can not hold a financial investment for an indeterminate duration should not spend in such offerings.

Expert Best Crowdfunding Sites For Accredited Investors – Wichita KS

All details provided here need to not be relied upon to make an investment choice and does not plan to make an offer or solicitation for the sale or acquisition of any kind of certain safety and securities, financial investments, or investment methods.

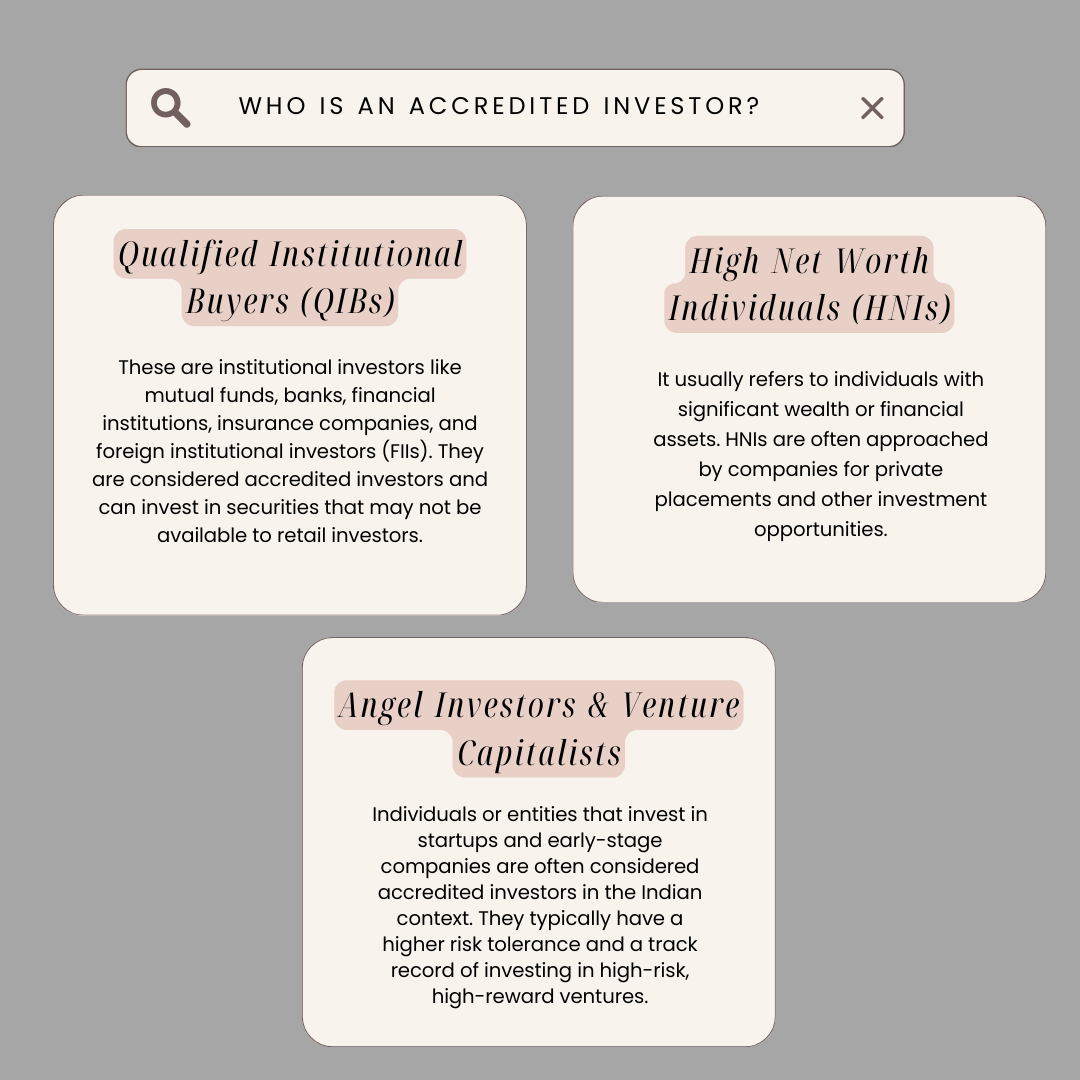

Approved financiers play a fundamental role in the customized area of personal positionings. This term, regulated by the Stocks and Exchange Commission (SEC), details that can take part in these substantial yet non-public financial investment possibilities. It is essential to recognize that qualifies as an accredited capitalist, their value secretive placements, and the impact of recently changed definitions on the financial investment arena for investors and providers.

To certify, an investor must have earned greater than $200,000 annually (or $300,000 with a spouse) in the last two years, or they must have an internet worth going beyond $1 million, independently or jointly with a spouse, not counting the value of their main home. These requirements ensure that investors have the needed economic acumen or safeguards to take care of the dangers related to these investments.

Secure Investments For Accredited Investors Near Me – Wichita KS

Therefore, recognized financiers are necessary for these bargains, offering services the opportunity to safeguard the essential funding with less restrictions. The broader meaning of recognized financiers has substantial ramifications for the personal positioning market: This growth includes experts with appropriate credentials, substantially expanding the swimming pool of prospective capitalists.

As the SEC updates the definition of an accredited financier, it's important to understand how these changes affect investors and companies alike. These adjustments affect who is eligible to buy personal placements and have more comprehensive implications for funding and technology within the economy. Expanding the certified financier standards will introduce much more opportunities, rise variety, and boost the strength of the personal funding markets.

Proven Private Investments For Accredited Investors – Wichita KS

The contemporary period has opened the door to numerous approved investor opportunities that it can make you woozy. It's one point to generate income; it's quite an additional keeping it and, certainly, doing what's required to make it grow. The sector has several verticals covering conventional possession classes like equities, bonds, REITs and mutual funds.

Approved investors have an one-of-a-kind advantage in the investment landscape, holding the secrets to a bigger selection of chances that have the capacity for considerable returns on investment (ROI). For those that have lately achieved this accreditation or are seeking it, there is a fundamental viewpoint to realize here - best crowdfunding sites for accredited investors. Earning this accessibility is not simply a ticket to elite financial investment circles but a contact us to tactical preparation and sharp decision-making

Therefore, we'll provide you with a much deeper understanding of what it implies to be a recognized capitalist and some tips on exactly how to leverage that gain access to for your ideal returns. Becoming a recognized capitalist suggests the doors are now available to a new world of even more complex investment options.

These financial investments need to only be managed by knowledgeable financiers that are fluent in a minimum of the basics of how they work and just how they behave. More financial investment options indicate you likewise have a lot more choices for diversification. This is among one of the most common methods to handle dangerexpanding your investments throughout different asset courses.

Professional Venture Capital For Accredited Investors – Wichita

Before joining the dotted line, discuss your research once more and make certain you comprehend the investment opportunities readily available to you. Take into consideration seeking economic specialists who agree to convey recommendations regarding whether you're making an educated choice (hedge funds for accredited investors). It's worth emphasizing that many recognized financial investments entail even more conjecture and higher threats

Accredited capitalists have the opportunity of accessing a lot more intricate financial investments past the reach of standard markets. A great motto to keep in mind is that the extra complicated the investment, the more advanced your strategy ought to be. These could consist of: Ventures right into personal equity, where investors can take considerable risks secretive companies Ventures right into hedge fundsknown for their aggressive techniques and prospective for high returns Direct financial investments in realty, providing concrete possessions with capacity for admiration and earnings Much more robust strategies are needed right here to minimize the fundamental risks such as illiquidity, higher volatility, and complex regulatory requirements.

Recognized financiers participating in complex financial investment approaches have a side effect of the need for an extra intricate tax obligation technique to accompany it. The structure of investments secretive equity, hedge funds, and property can have differed tax implications, including: Funding acquires taxes Passion deductions Distinct chances for tax obligation deferral Making best use of tax obligation effectiveness entails tactical preparation to utilize tax-advantaged accounts, comprehending the ramifications of short-term vs.

High-yield investments draw in numerous capitalists for their cash circulation. You can purchase a possession and get awarded for holding onto it. Certified capitalists have much more opportunities than retail financiers with high-yield investments and past. A greater range offers accredited financiers the opportunity to obtain higher returns than retail capitalists. Accredited financiers are not your regular financiers.

Profitable Venture Capital For Accredited Investors – Wichita KS

You need to satisfy at the very least one of the adhering to parameters to end up being a recognized investor: You should have more than $1 million web well worth, excluding your primary house. Business entities count as accredited investors if they have more than $5 million in properties under management. You must have an annual revenue that exceeds $200,000/ yr ($300,000/ year for companions filing together) You must be a licensed investment advisor or broker.

Table of Contents

- – Proven Passive Income For Accredited Investors

- – Expert Best Crowdfunding Sites For Accredited ...

- – Secure Investments For Accredited Investors N...

- – Proven Private Investments For Accredited Inv...

- – Professional Venture Capital For Accredited ...

- – Profitable Venture Capital For Accredited In...

Latest Posts

Tax Lien Investing Strategies

Tax Sale Overages List

Government Tax Auction Homes

More

Latest Posts

Tax Lien Investing Strategies

Tax Sale Overages List

Government Tax Auction Homes